MT4 after twenty years: an honest take on the platform

MT4 in 2026: why it refuses to die

MetaQuotes stopped issuing new MT4 licences a while back, pushing brokers toward MT5. Yet most retail forex traders haven't moved. The reason is straightforward: MT4 does one thing well. More than a decade's worth of custom indicators, Expert Advisors, and community scripts only work with MT4. Switching to MT5 means rewriting that entire library, and most traders would rather keep trading than recoding.

I spent time testing MT4 and MT5 side by side, and the differences are smaller than you'd expect. MT5 adds a few extras including more timeframes and a built-in economic calendar, but the charting is very similar. Unless you need MT5-specific features, there's no compelling reason to switch.

Getting MT4 configured properly the first time

Installation takes a few minutes. The part that trips people up is the setup after install. By default, MT4 opens with four charts squeezed onto a single workspace. Clear the lot and open just the pairs you follow.

Chart templates save time. Build your usual indicators on one chart, then save it as a template. From there you can apply it to any new chart without redoing the work. Sounds trivial, but over months it saves hours.

A quick tweak that helps: open Tools > Options > Charts and tick "Show ask line." The default view is the bid price by default, which can make buy entries seem misaligned by the spread amount.

Backtesting on MT4: what the results actually mean

The strategy tester in MT4 allows you to run Expert Advisors against historical data. Worth noting though: the accuracy of those results depends entirely on your tick data. The default history data is modelled, meaning the tester fills gaps mathematically. If you're testing something that needs accuracy, download real tick data from a provider like Dukascopy.

That quality percentage in the results is more important than the profit figure. Anything below 90% means the results are probably misleading. People occasionally show off backtests with 25% modelling quality and ask why the EA fails in real conditions.

The strategy tester is one of MT4's stronger features, but it's only as good as the data you give it.

MT4 indicators beyond the defaults

MT4 comes with 30 default technical indicators. The average trader uses maybe a handful. But the real depth lives in custom indicators built with MQL4. There are over 2,000 options, covering everything from simple moving average variations to elaborate signal panels.

Installing them is straightforward: place the .ex4 or .mq4 file into the MQL4/Indicators folder, restart MT4, and you'll find it in the Navigator panel. One thing to watch is quality. Publicly shared indicators range from excellent to broken. Some are genuinely useful. Many haven't been updated since 2015 and may crash your terminal.

If you're downloading custom indicators, check how recently it was maintained and whether users mention bugs. Bad code doesn't only show wrong data — it can lag the whole terminal.

Risk management settings most MT4 traders ignore

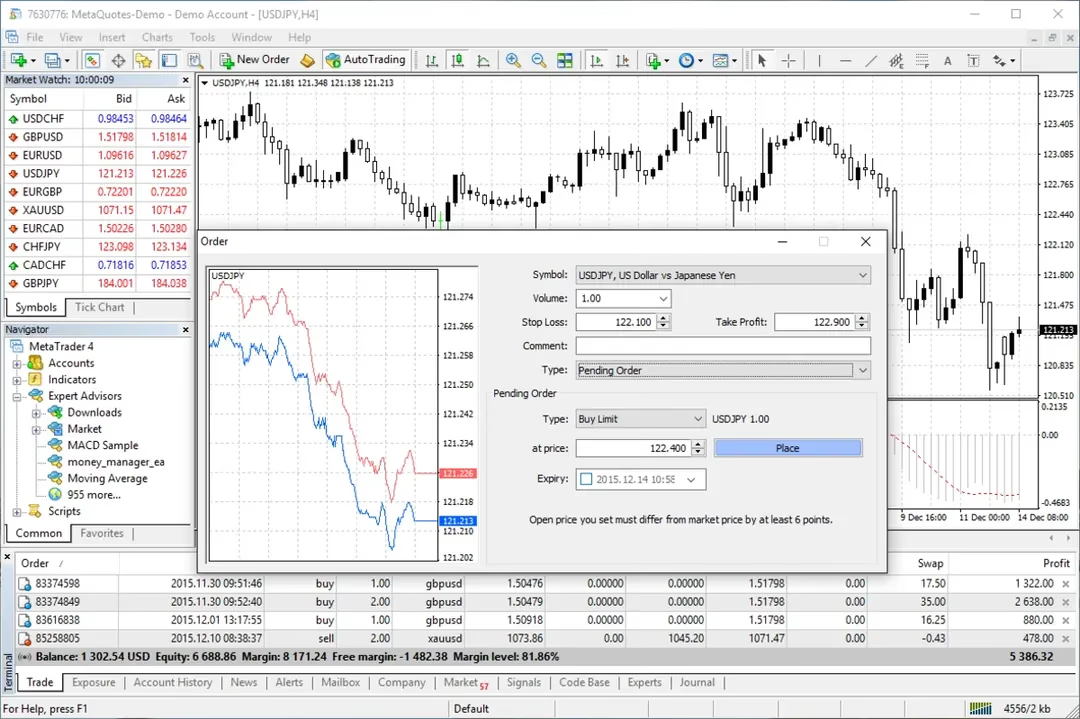

MT4 has a few native risk management tools that the majority of users skip over. The most useful is the maximum deviation setting in the new order panel. This defines how much slippage is acceptable on market orders. If you don't set it and you'll get whatever price comes through.

Stop losses are obvious, but MT4's trailing stop feature is worth exploring. Click on an open trade, select Trailing Stop, and define your preferred distance. Your stop loss moves automatically as the trade goes into profit. Doesn't work well in choppy markets, but for trend-following it removes the urge to stare at the screen.

These settings take a minute to configure and they remove a lot of the emotional decision-making.

EAs on MT4: what to realistically expect

Expert Advisors on MT4 sounds appealing: set rules, let the code trade, walk away. The reality is, the majority of Expert Advisors lose money over any extended time period. The ones sold with flawless equity curves are often fitted to past data — they look great on the specific data they were tested on and stop working once conditions shift.

This isn't to say all EAs are worthless. A few people develop personal EAs to handle specific, narrow tasks: time-based entries, managing position sizing, or taking profit at fixed levels. These smaller, focused scripts work because read more here they handle defined operations where you don't need discretion.

When looking at Expert Advisors, test on demo first for a minimum of two to three months. Running it forward in real time reveals more than historical results ever will.

MT4 beyond the desktop

The platform was designed for Windows. Mac users face compromises. The old method was Wine or PlayOnMac, which mostly worked but came with rendering issues and the odd crash. Some brokers now offer macOS versions using compatibility layers, which are better but still aren't true native apps.

On mobile, available for both iPhone and Android, are surprisingly capable for monitoring your account and making quick adjustments. Serious charting work on a 5-inch screen doesn't really work, but closing a trade on the go is worth having.

Look into whether your broker has a proper macOS version or just Wine under the hood — the experience varies a lot between the two.